Introduction

Traditional higher ed has largely forgone the growing lifelong learning market. In its place, the space has been filled by providers who describe their programs as alternative credentials.

But alternative is a misnomer. Certificate programs are not an alternative to degree programs; the great majority of people earning them already have their bachelor’s degrees. What they really are is extensions. And this extended learning represents a tremendous opportunity for universities.

Alternative Credentials Aren’t an Alternative to Degrees

Alternative credentials encompass a broad swath of emerging offerings, from standalone MOOC-like courses to stackable certificates and microcredentials. This multibillion dollar market consists of over a million credentials offered by tens of thousands of providers, most of whom are not higher ed institutions. The 10-15% annual growth in lifelong learning reflects unprecedented rates of change in the world, requiring more-broadly skilled individuals who consistently upskill and reskill. This rate of change is unlikely to slow down anytime soon.

That said, these programs are not replacements for degree programs. The overwhelming majority of “alternative” learners already have their bachelor’s degree; more than 90% of the graduates of tech bootcamps, for example, already have their BA. The arguments to the contrary are wishful thinking: while Google and others have dropped the requirement for a bachelor’s, a recent study shows only 1 in 7000 actual hires doesn’t have one.

This is unlikely to change soon. The certificate space is incoherent: programs bearing the same name might require eight hours of instruction or eight months, and the security protocols are minimal. It’s almost impossible for a company to include any certificate in its job description requirements. By comparison, a master’s degree varies in many ways from university to university, but its meaning and credibility remains consistent.

Degrees Still Matter

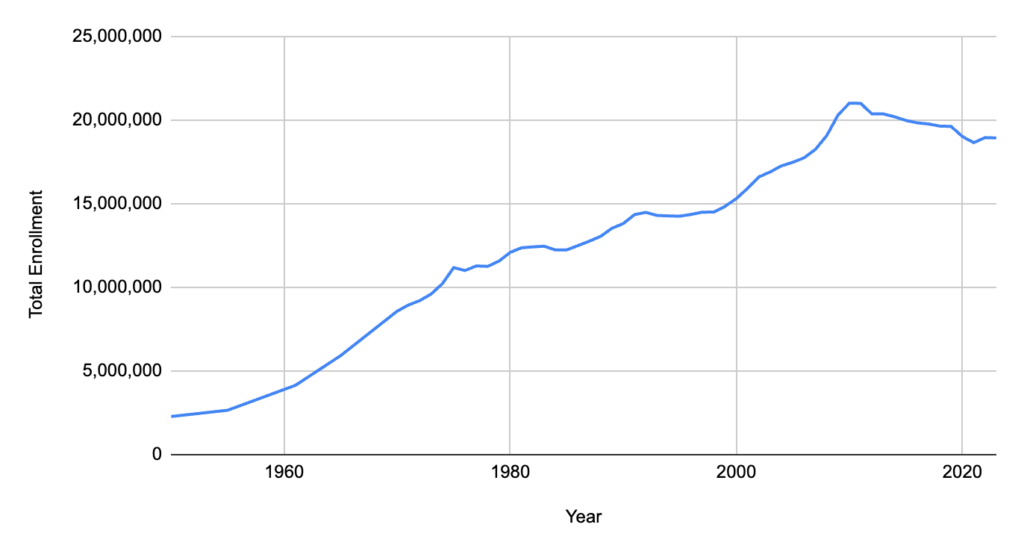

Without a doubt, universities face financial and other challenges. A decade-long decline for undergraduate and graduate degrees that predated COVID has put pressure on university revenues (while this trend is more pronounced in Northeastern and Midwestern states, it is evident throughout the country). The decline in degrees is driven by both demographic and cultural challenges that make college less attractive.

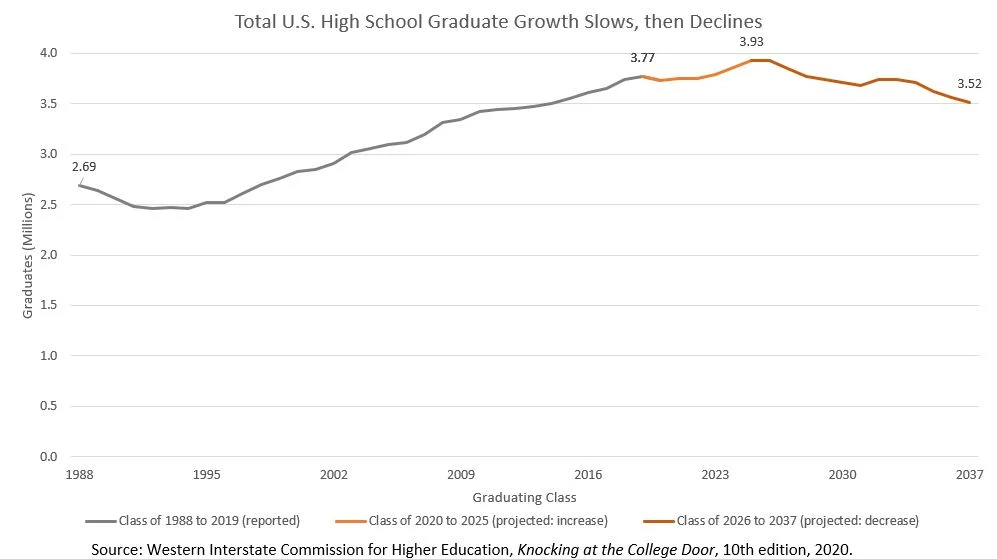

In the US, the birth rate has largely declined over the last 70 years, falling to nearly half its 1950 level. This so-called birth dearth is expected to continue in the coming years, shrinking the number of high school graduates who might enroll directly into college.

Concerns over the affordability of college and student debt, combined with a relatively strong labor market post-pandemic, have led some to question the value of a degree and altered the demographics of college attendees. According to NCES, 73% of learners in 2022 were considered nontraditional due to their age, employment status, and other factors. The protests over the Middle East war have further embroiled higher ed in the culture wars, potentially alienating funders and politically conservative students.

Together, these shifts are projected to result in a 15% drop in traditional college-going students.

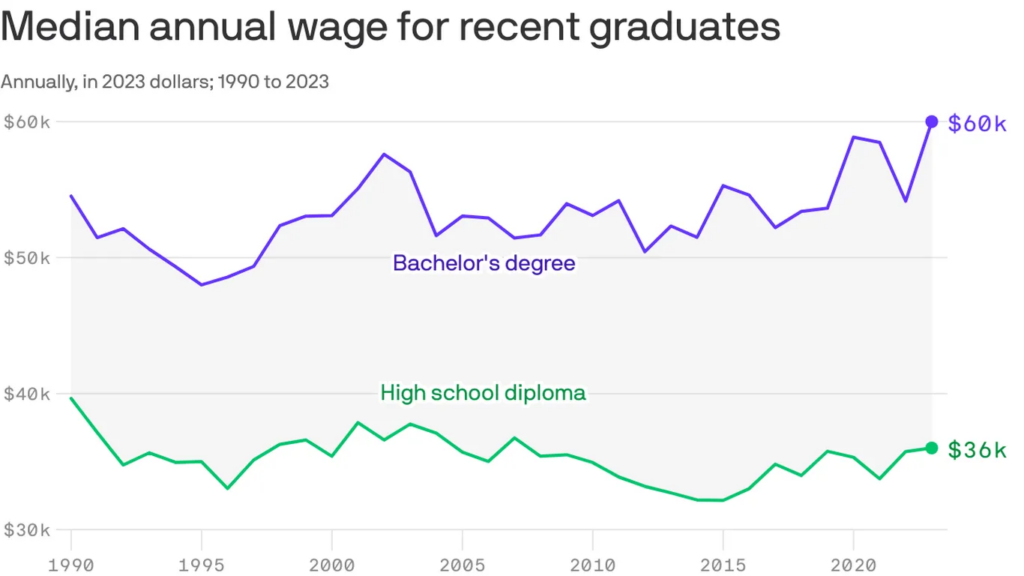

While these are serious challenges, the return on investment of a college or graduate degree from traditional universities continues to rise as the information economy expands to new sectors. According to Georgetown University’s Center on Education and the Workforce, forgoing college results in up to 75% lower lifetime earnings. Rather than reduce this gap, extended credentials simply give degree earners a flexible learning path to their next job.

Alternative Credentials Are Opportunities for Extended Learning

While the competitive threat posed by alternative credentials is overstated, the opportunity for universities to become the dominant provider of those credentials is not. This is no small thing; at $120 billion in 2023, the lifelong learning market is already larger than that of grad school, and it is growing at 10-15% per year.

Lifelong learning is dominated by for-profit institutions and by platforms like Coursera and EdX. These organizations have many thousands of courses and large sales forces. Higher ed, despite its reputation for quality and its existing relationships with most lifelong learners, claims a vanishingly small part of the sector. Serving this extended learning market could grow universities significantly.

But this is more than just a new and large revenue opportunity. Extended credential programs are a chance to create lifelong relationships with alumni. The average member of Gen Z will switch jobs 15-20 times over their lifetime; many of those changes will constitute new careers. Universities have long spoken about the difficulty of adding value to someone’s whole life but having to fund that education in only four years. Here is an opportunity to support alumni throughout these transitions in a meaningful way, which could support engagement, community, and (yes) giving.

In addition, most universities have relationships with a range of local, regional, and national employers. Helping those employers solve their problems—whether an employee needs a short course or a full master’s—will create a more robust pipeline for a school’s graduates.

Universities Are Uniquely Positioned to Dominate

Universities are stewards of education and hubs of collaboration. Creatively capitalizing on these institutional strengths enables them to be leaders in extended credentials, reshaping lifelong learning from a morass of offerings into curated pathways.

Unlike other content providers, universities have been built to disseminate content and skills. This extends beyond content into the institutions themselves. Universities offer rich programming—both online and on campus—and have access to renowned leaders, faculty, and experts in varied disciplines. This enables higher ed to build an incomparable ecosystem around a lifelong learner. Learning goes beyond course content to cutting-edge research, access to leading faculty, and events. Further, although 97% of learners choose online courses for flexibility, many of those learners want in-person opportunities to network. University campuses offer an easy solution for in-person networking and other enrichment experiences.

Going It Alone Is Resource-Intensive

That’s not to say addressing the extended learning space will be easy. With few exceptions, a single university cannot address it alone without a massive investment.

First, almost no single university has the necessary breadth of high-quality content (UMichigan and Harvard Extension may be exceptions) to address the needs of any one part of this space. Consider how widely the professional development needs of teachers vary: they teach a variety of subjects to students of different ages and demographics, and they bring a broad range of experience and skills. Any university, even one renowned in teacher training, would be able to address only a small percent of teachers’ needs.

Second, a university typically does not have a national or global sales force. This makes competing with entrenched competitors with local recognition challenging. The challenges in selling make expansion difficult—which, in turn, impairs the investment theses for content development.

Seeing these hurdles, some schools have focused their lifelong learning efforts on niche offerings or primarily on their alumni. But this strategy depends on high engagement from a small population, a high-risk strategy with relatively low impact.

Education Platforms Might Scale, But at a High Cost to a University

Universities have tried to address these issues of scale by joining marketplace platforms to gain access to a dedicated salesforce and to a global marketing channel, as well as to broaden their appeal by co-promoting into a wider catalog.

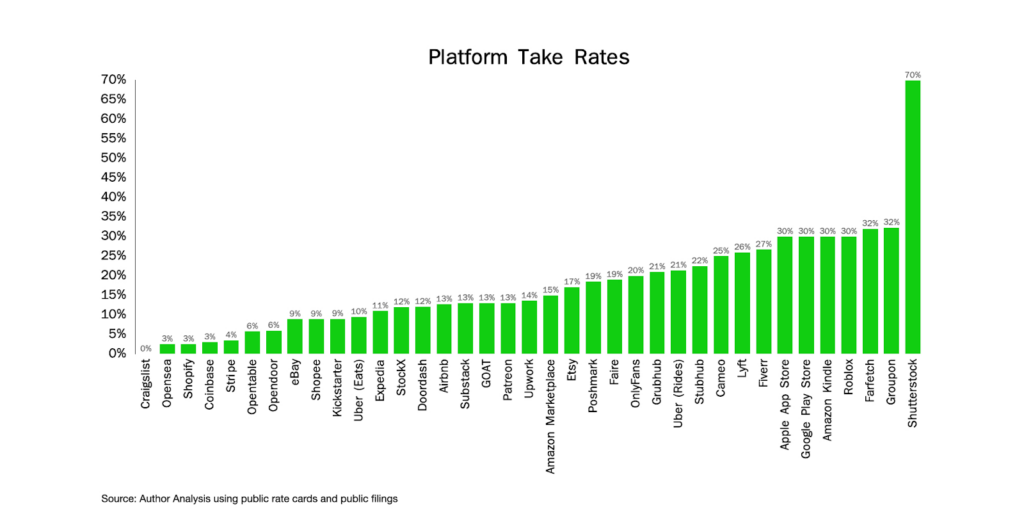

These platforms, however, come at high cost to universities. Financially, these platforms take upwards of 50-80% of revenues from universities to participate in the marketplace. This is unusual, as most marketplaces outside education have a revenue share of 15-30%. As a recent Harvard Business Review article notes, “Platforms can extract higher fees over time, particularly as they become more powerful and entrenched, and face less competition.”

University brands are powerful, but participating in a platform cedes that branding benefit to the platform. Universities also have no say over which brands and courses they are packaged with, making it difficult to differentiate their content meaningfully and further ceding brand control. The reputational impact also extends into the learning experience. These platforms typically have low retention and completion rates: only about 3% of Coursera learners finish the courses they start.

Participation in these platforms may be advantageous as part of a broader strategy to compete in lifelong learning. However, to scale most effectively, universities need to employ technology that enables collaboration. While online MOOC platforms create comprehensive catalogs for learners, they do so largely at the expense of the universities. A truly collaborative platform would put the power and decision-making with the universities themselves, enabling each to opt into sharing and marketing as much or as little content to every other member as they wished.

Collaboration Unlocks Opportunity

As hubs of collaboration, universities should lean in with other universities to expand higher education’s capacity to compete in the lifelong learning space, without sacrificing the quality of the educational experience. A university network—where schools can coalesce content across their respective catalogs into a single platform—delivers the scale of content required in a marketplace, while distributing the cost of development across the member universities.

Collaboration fuels universities to invest in innovative content—rather than 100 versions of the same baseline content, each university can now specialize in the knowledge areas, formats, and research that are most relevant to their students, faculty, and communities.

Collaboration as a means to innovate efficiently can be seen in other industries. Ford and GM, for example, agreed to share technologies to free funds for their EV efforts; likewise, BioNTech, Fosun Pharma, and Pfizer worked together to launch their COVID vaccines. Universities working as a network can similarly unlock efficiencies that allow more content innovation and catalog strength to compete with providers of lifelong learning.

New Technologies Can Help

New technology can help universities leapfrog the challenges of succeeding in lifelong learning by accelerating the enrollment process, making learning more joyful, and creating personalized learning experiences. New learning tools, like augmented reality (AR), can also more dynamically deliver meaningful online experiences, enabling universities to reach new audiences with their unique pedagogy. Deploying artificial intelligence can cut through the noise of a crowded marketplace, scaling traditional enrollment and career services into recommendation engines for frictionless conversion. With technology and collaboration, universities can become an education partner over a learner’s lifetime, not just for four years.

Summary

The extended credential market is not a threat to higher education. Rather, it’s a large opportunity. Approaching that opportunity in collaboration with other universities can minimize the risks and maximize the impact of higher ed on the lifelong learning marketplace. With collaboration, and through technology, universities can realize the opportunity of lifelong learning and create better additive education for all.